- This event has passed.

+21.81

XAU/USD

Left side lots of liquidity. But then again, We’re in a bit of a manipulation for the start of the month, so should not expect too much for distributions. Currently in 1-1.5 SBZ. 2:00 [4H] dist, 4:00 [1H] manipulation macro, retesting the open for distribution after mani.

Because of the monthly accumulation, I could also see that it has already reached 2-2.5, so I’m loading up with caution, and being Gold, commissions will be heavy.

Liquidated more than half of my position before my targets. Loss aversion? Look into that.

Not sure why but I keep closing early. Maybe it’s sleep? Or fear. Lost more than 3x in profits.

Good

- Perfect read (AMD)

Neutral

Bad

- Panic sold / Loss aversion cost me half of potential profit

NY SESSION

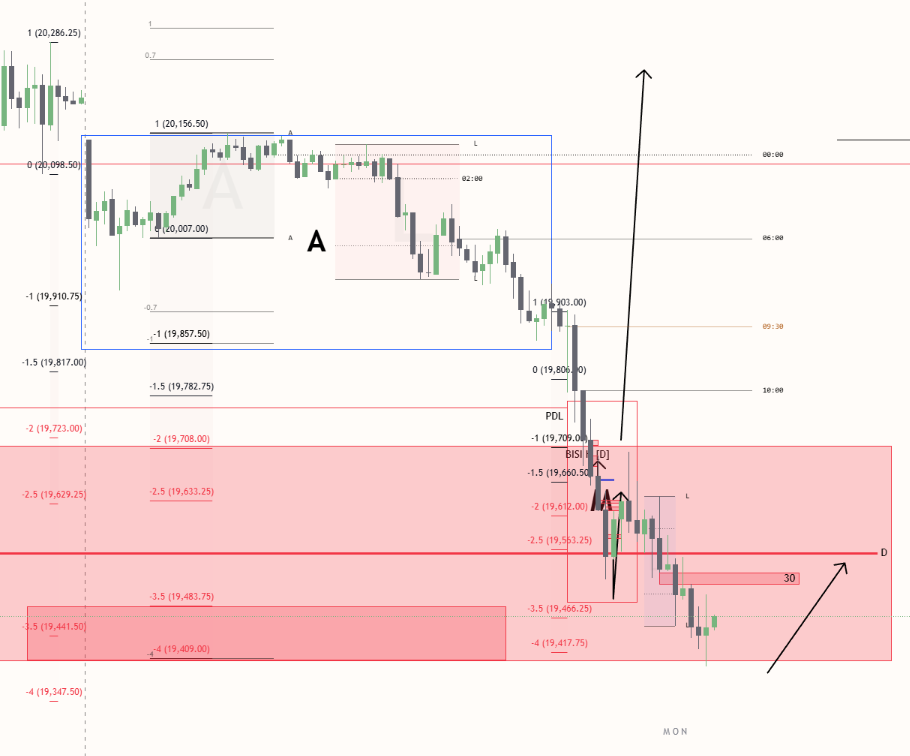

NQ

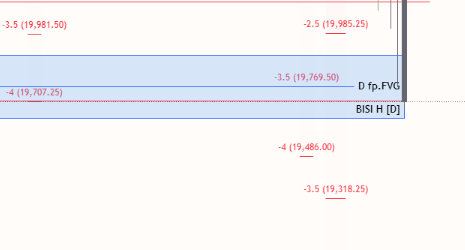

wicked reversal pattern on the 6H / Daily. Extensions tells a potential reversal at 3.5-4 clusters. Very light risk (0.01 lot on CFD). If I’m right about a reversal, I’ll bag near 1% but losses will be pretty minor.

PDL purged. If it’s a HTF reversals, I can expect both PDL and PDH to be taken, therefore, highest targets at PDH. Extension reversal cluster, Daily FVG highs, inside inverted Daily First Presentation FVG of the month of Sept. 2024 ? Not too much of a significance now that I think about it. I’m more interested in the unclaimed Daily FVG highs.

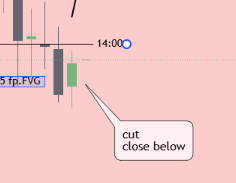

5m pattern holds but hard to trade when 15s FVG are holding for downside even at reversal point

last buy attempts.

NAS

14:00 Po3, 1H pattern for intraday reversals. TGIF for 20-30% retracements.

new extension clusters

good 1m pattern for continuations and 2.2-5 met. Break Even.

Good

- Patient. More like I afk’d and came back at a more opportune time. This is key for reversal trades when price is continuously dropping.

- Quick to take profit on reversals. The likelihood of the big reversal I’m seeking is very low, therefore intraday reversals is the way to go.

- Good read throughout. Nice calls on 4H Po3, FVGs, and knowing when to cut as soon as something becomes disrespected.

Neutral

Bad

- Still a bit keen on taking lots of positions for reversal trades. Reversal trades should only be at terminal areas.

Key Takeaways:

- Be careful loading up counter trend trades and be vigilant.